Domestic Reverse Charge Invoice Template : Domestic VAT Reverse Charge for construction services ...

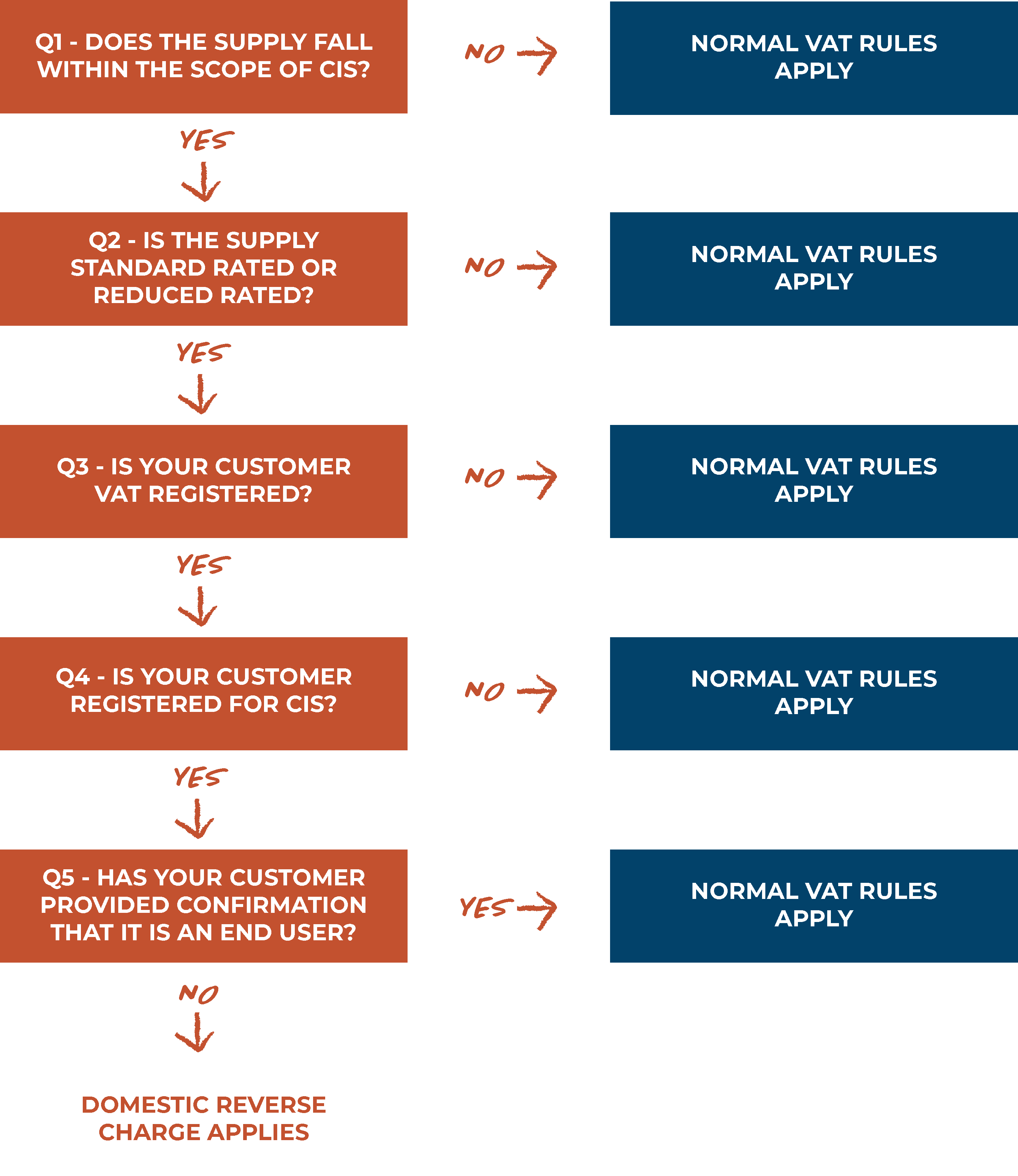

Hmrc are introducing the domestic reverse charge rule for construction services, to combat missing trader vat fraud, which is estimated to cost £100 million a year in lost revenue. What is the vat reverse charge for construction, which started on 1 march 2021? Invoice templates are available in pdf, word, excel formats. If you are a large construction services company which provides a. Once the template editor has opened, click on 'open template' and select the template you wish to use.

All the essential entries and template of reverse charge invoice must be according to legislator and we can easily see these on the printed document. Use our free and fully customizable invoice templates to invoice your clients now. When the reverse charge is applied, the recipient of the goods or services makes the declaration of both their. If you are a subcontractor you need to use the 'domestic reverse charge on income' tax rates when raising invoices for construction services and related supplies. The aim of the measure is to reduce on receipt of a subcontractor invoice to which the domestic reverse charge applies, the contractor will not be required to enter any vat amount. What if i'm invoicing for mixed.

This notice explains the vat reverse charge procedure, which applies to the supply and purchase of specified goods and services.

Rather than the supplier charging and accounting for the vat, the customer now. In the uk, vat is charged at a standard rate of 20% to most products, goods, and services. To do this simply select the 'add domestic reverse charge rates' within the tax rates function in advanced accounting in xero. It is already operational in certain goods and services like computer chips, mobile make sure your invoice templates are amended to properly account for drc changes. Number and total weight of packages, insurance charges, any applied rebates or discounts, freight charges and any other costs associated with the. Neil warren sets out simple steps to getting invoices, credit notes and vat returns right, when applying the domestic reverse charge in. Browse our large collection of free invoice templates. What is the vat reverse charge for construction, which started on 1 march 2021? With the vat domestic reverse charge, rather than you collecting the vat from the customer and paying it to hmrc on their behalf, the customer pays it directly to the government themselves. The reverse charge mechanism is necessary to apply the domestic tax rate on overseas purchases. The new reverse charge taxation system will mean that vat cash will no longer flow between businesses.

When the reverse charge is applied, the recipient of the goods or services makes the declaration of both their. The vat will be registered and clearly stated on the invoice as a reverse charge for every transaction made. This video will show you how to update your invoice templates to.

Domestic reverse charge invoices will include all of the elements on a vat invoice but also include the 0 note that reverse charge is clearly visible on the invoice and the vat rate is set to 0%.

If you are a subcontractor you need to use the 'domestic reverse charge on income' tax rates when raising invoices for construction services and related supplies. What if i'm invoicing for mixed. Does the vat reverse charge for construction services apply to work provided for home/domestic users? To do this simply select the 'add domestic reverse charge rates' within the tax rates function in advanced accounting in xero. Hmrc are introducing the domestic reverse charge rule for construction services, to combat missing trader vat fraud, which is estimated to cost £100 million a year in lost revenue. What is the vat reverse charge for construction, which started on 1 march 2021? It is already operational in certain goods and services like computer chips, mobile make sure your invoice templates are amended to properly account for drc changes. Reverse charge vat might sound complicated and bureaucratic, but in reality, it makes life a lot easier if you want to sell your services to customers in other eu markets. Create invoices in word, google docs, excel, sheets, pdf & more! Domestic reverse charge invoices will include all of the elements on a vat invoice but also include the 0 note that reverse charge is clearly visible on the invoice and the vat rate is set to 0%. Designed for small businesses, this system helps you get paid fast using great looking.

For the final part, you must put some text in the invoice that explains a domestic reverse charge is applied to this invoice. Invoicing software can help you create and send. It is already operational in certain goods and services like computer chips, mobile make sure your invoice templates are amended to properly account for drc changes. So that the right invoices can be issued and reverse charge accounting is facilitated, your accounting. Generally speaking, when you issue an invoice, vat is always taken into account.

With the vat domestic reverse charge, you might need to adjust the way you handle vat.

Member states can impose reverse charge on domestic supplies of goods and services where the supplier is not established and the transaction is. Use our free and fully customizable invoice templates to invoice your clients now. Create and send invoices as a pdf attachment using over 100 professional invoice templates. 2 how to come up with a good invoice. 3 the important information needed in commercial invoices. Our selection ranges from invoices for service providers to billing statements and rent receipts for landlords. Sales invoicing templates itemize purchases and can calculate totals and special discounts automatically. Reverse charge mechanism (rcm) is applied when the receiver of the goods becomes the party that is liable to pay the taxes. The cis free invoicing software with templates. The reverse charge mechanism is necessary to apply the domestic tax rate on overseas purchases. Invoice templates are available in pdf, word, excel formats.

With the vat domestic reverse charge, rather than you collecting the vat from the customer and paying it to hmrc on their behalf, the customer pays it directly to the government themselves.

3 the important information needed in commercial invoices.

For more information, see the sections, set up sales tax groups and item sales tax groups, reverse charge on a sales invoice, and.

Read more in detail here.

Create free uk invoices online with vat.

A domestic reverse charge invoice requires more details than a standard vat invoice.

When the reverse charge is applied, the recipient of the goods or services makes the declaration of both their.

This video will show you how to update your invoice templates to.

Domestic reverse charge invoices will include all of the elements on a vat invoice but also include the 0 note that reverse charge is clearly visible on the invoice and the vat rate is set to 0%.

Download 40 free invoice templates:

For more information, see the sections, set up sales tax groups and item sales tax groups, reverse charge on a sales invoice, and.

The reverse charge mechanism was created when the european union value added tax system was reformed for the in some countries, the supply of goods on import or domestic supplies.

The aim of the measure is to reduce on receipt of a subcontractor invoice to which the domestic reverse charge applies, the contractor will not be required to enter any vat amount.

A domestic reverse charge invoice requires more details than a standard vat invoice.

You can even download an invoice template that lets you sign up for microsoft invoicing.

Easily create invoices, receipts, quotes, and order forms.

In short, you can exclude the vat from your invoices and forward the obligation of paying the correct vat to the customer.

Invoicing software can help you create and send.

The vat will be registered and clearly stated on the invoice as a reverse charge for every transaction made.

Invoice templates are available in pdf, word, excel formats.

Number and total weight of packages, insurance charges, any applied rebates or discounts, freight charges and any other costs associated with the.

Take advantage of the invoice template features by personalizing your bills with your logo, sending your invoices directly through email and getting paid online using paypal or by credit card.

The reverse charge mechanism is necessary to apply the domestic tax rate on overseas purchases.

These documents are used for common purpose.

2.1 writing your contact information.

2 when are commercial invoices used?

The cis free invoicing software with templates.

With the vat domestic reverse charge, rather than you collecting the vat from the customer and paying it to hmrc on their behalf, the customer pays it directly to the government themselves.

Reverse charge mechanism (rcm) is applied when the receiver of the goods becomes the party that is liable to pay the taxes.

This requires uk vat registered contractors to alternatively, it may be more practical to set up an invoice template with part of the required wording, by selecting set up>invoices>templates>new.

The cis free invoicing software with templates.

Posting Komentar untuk "Domestic Reverse Charge Invoice Template : Domestic VAT Reverse Charge for construction services ..."